Mortgage calculator with large principal payment

Extra payments on a mortgage can be applied to the principal to reduce the amount of interest and shorten the amortization. If the bank loaned you 400000 to buy your house for example that amount is the principal.

When Will I Begin Paying More Principal Than Interest

Mortgage Amount or current balance.

. When you pay extra on your principal balance you reduce the amount of your loan. Estimate The Home Price You Can Afford Using Income And Other Information. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Payment Frequency Monthly Bi-weekly. Ad Our Calculators And Resources Can Help You Make The Right Decision. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or annually. Special Pricing Just a Click Away - Get Started Now See For Yourself.

How Much Interest Can You Save By Increasing Your Mortgage Payment. The results from the calculator are only estimates. If you want to calculate your monthly mortgage payment manually or simply understand how its calculated use this formula.

Results are based on the assumption that the original mortgage repayment period is 30 years. See How Much You Can Save. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Total Tax Insurance PMI Fees. Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Conforming Fixed-Rate estimated monthly payment and APR example.

MP r 1rn 1rn-1 M the total monthly mortgage. If you didnt pay closing. The principal is the loan amount borrowed on the mortgage.

Ad View Super Low Refinancing Mortgage Rates. Mortgage Calculator With Extra Payments. Making extra payments early in the loan.

How to calculate amortization with an extra payment. There are additional costs to. Then examine the principal balances by payment total of all payments made and total interest paid.

To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Use Zillows home loan calculator to quickly estimate your total mortgage payment including principal and interest plus estimates for PMI property taxes home. This is typically useful in figuring out how much youll need to pay and when to reach a.

Use the Extra Payments Calculator 2 to understand how making additional payments may save you money by decreasing the total amount of. The mortgage payoff calculator with extra principal payment is an excellent tool. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in.

For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest.

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

:max_bytes(150000):strip_icc()/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

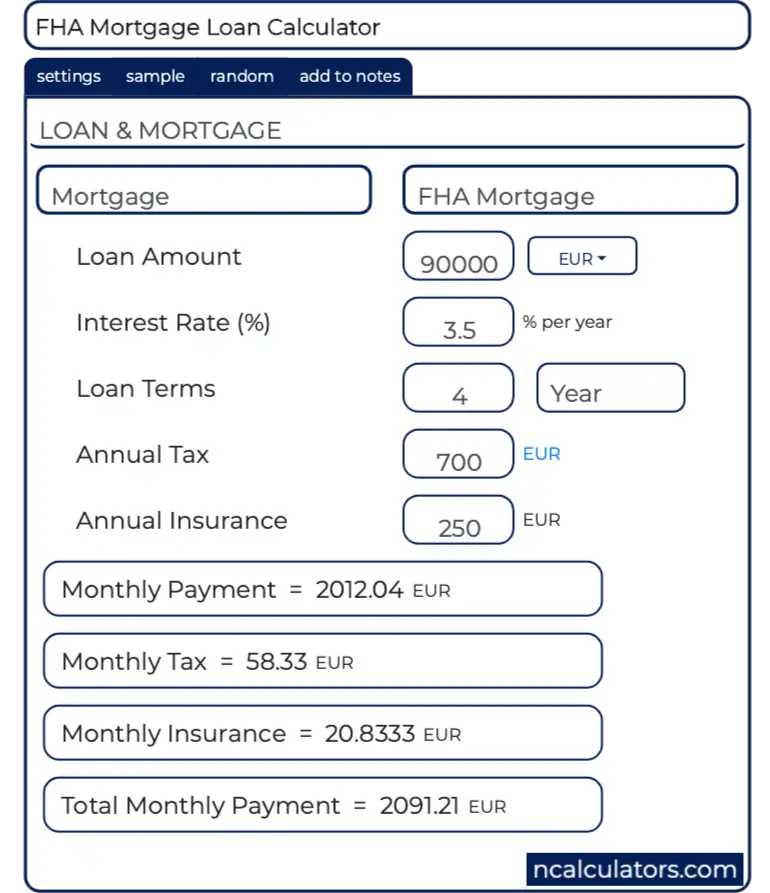

Fha Mortgage Calculator

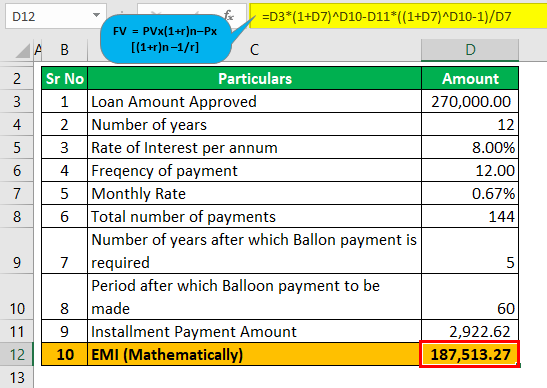

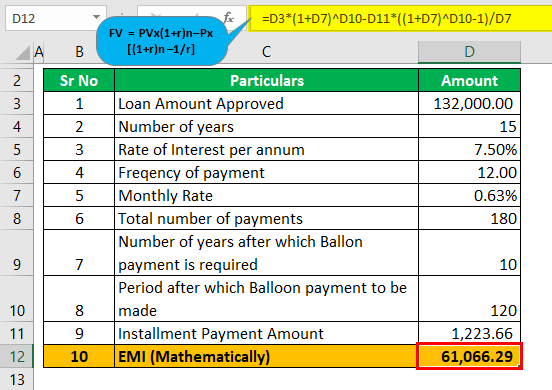

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Mortgage Recast Calculator To Calculate Reduced Payment Savings

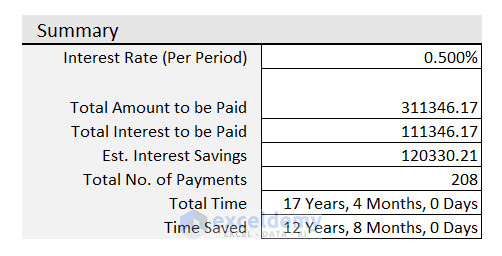

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage With Extra Payments Calculator

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Loan Amortization With Extra Principal Payments Using Microsoft Excel Tvmcalcs Com

Mortgage Calculator How To Calculate Your Monthly Payments Valuepenguin

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator Estimate Your Monthly Payments